Key Takeaways

XRP’s market capitalization surpassed $100 billion for the primary time in over six years.

XRP’s worth surged as a result of market optimism following pro-crypto political developments.

Share this text

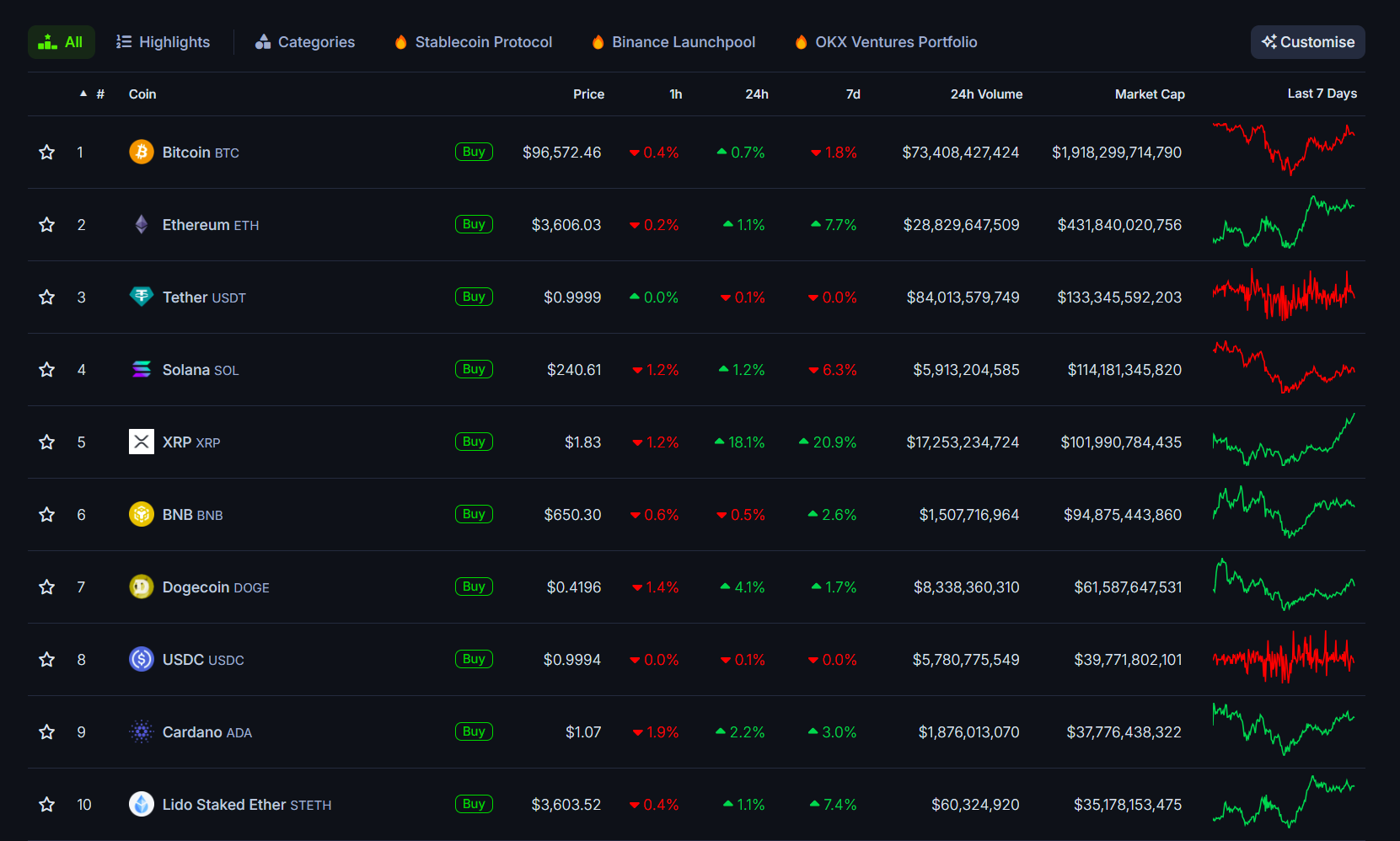

XRP’s market capitalization surpassed $100 billion on Friday, reaching its highest degree since January 2018 and overtaking BNB to turn into the fifth-largest crypto asset by market worth, in keeping with CoinGecko information.

The token’s worth jumped 18% to $1.8 within the final 24 hours, with weekly beneficial properties of twenty-two%. XRP has gained 193% because the begin of the 12 months. The asset now trails solely Bitcoin, Ethereum, Tether, and Solana, with SOL’s market cap at roughly $114 billion in comparison with XRP’s $101 billion.

XRP started its upward pattern after Donald Trump gained the presidency. Trump’s pro-crypto stance brings hope that the sector will thrive below his second time period. This has instilled optimism amongst buyers and led to a market-wide rally.

Whereas Trump’s re-election positively impacts XRP, its greatest beneficial properties are primarily tied to SEC Chair Gary Gensler’s resignation.

The token broke above $1 for the primary time since November 2021 after Gensler hinted at resignation, and subsequently surged 25% to $1.4 upon his official announcement.

Gensler’s resignation is seen as a possible turning level in Ripple’s authorized state of affairs. Consultants imagine that ongoing SEC instances in opposition to crypto firms, together with Ripple, could also be dismissed or settled.

Optimistic developments within the stablecoin roadmap, coupled with Ripple’s ongoing enterprise enlargement and rising institutional adoption, are additionally fueling XRP’s worth surge.

Asset managers like Bitwise and Canary Capital are actively pursuing SEC approval to launch XRP ETFs.

The blockchain firm is predicted to safe approval from the New York Division of Monetary Companies to launch its RLUSD stablecoin.

XRP’s bullish run faces potential short-term correction

If bulls proceed to take cost, XRP might attain $1.90 and even $2. Nevertheless, CryptoQuant group analyst Maartunn warns that the latest worth improve is essentially pushed by leveraged buying and selling, an element that may result in vital worth swings. An identical occasion previously resulted in a 17% correction.

🚨 $XRP is experiencing a Leverage-Pushed Pump!

Open Curiosity is up 37% already—look ahead to volatility. The final related occasion led to a -17% drawdown.

Keep sharp, handle danger accordingly.#XRP #Crypto #Ripple #Onchain #Futures pic.twitter.com/Femb2xQKDH

— Maartunn (@JA_Maartun) November 29, 2024

Plus, XRP’s Relative Energy Index (RSI) is at the moment sitting at 89. An RSI above 70 signifies overbought situations, suggesting that the asset could also be due for a pullback.

But, it’s necessary to notice that the RSI can stay in overbought territory for prolonged intervals throughout sturdy bullish developments with out leading to a worth correction. Merchants are suggested to train warning and handle their danger, given the potential for volatility within the quick time period.

Share this text