Key Takeaways

None of Tesla’s 11,509 Bitcoin was bought in Q1 2025.

Vitality technology and storage income for Tesla grew by 67% within the first quarter.

Share this text

Tesla held 11,509 Bitcoin in its reserves all through Q1 2025 with out promoting any, in response to the corporate’s first-quarter earnings report launched on April 22.

The electrical automobile maker stays dedicated to its Bitcoin holding technique no matter market situations.

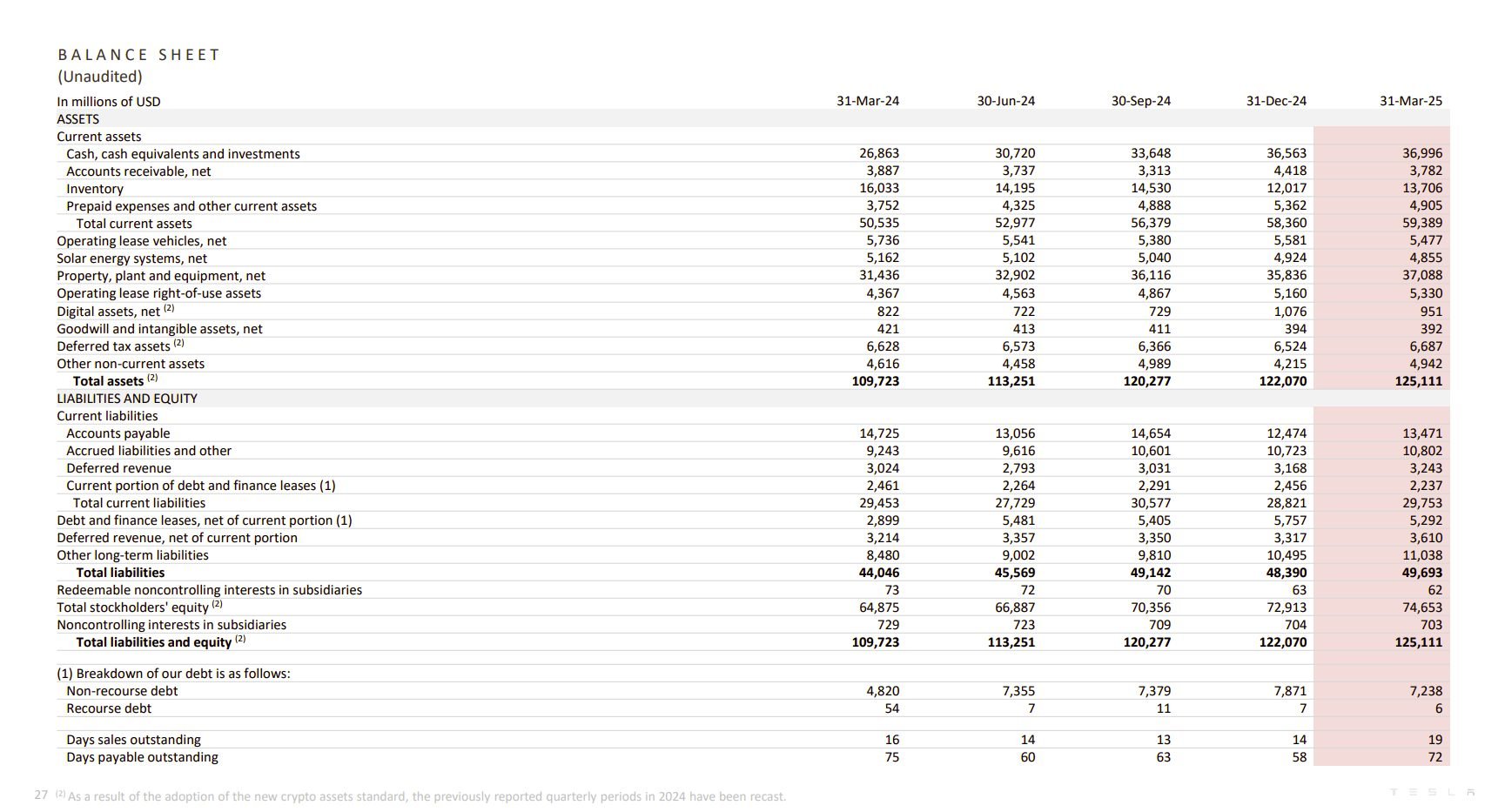

Bitcoin ended the primary quarter down roughly 12%, leaving Tesla’s Bitcoin holdings valued at round $951 million by the tip of Q1 2025, in response to the report.

Nonetheless, with Bitcoin surging about 6% to $93,000 on Tuesday, the worth of Tesla’s Bitcoin stash has climbed again above $1 billion, knowledge from TradingView reveals.

Whereas its Bitcoin place remained untouched, Tesla’s Q1 2025 earnings report revealed a number of adjustments throughout its core enterprise.

Tesla reported disappointing quarterly monetary outcomes, with adjusted earnings per share of $0.27, lacking analysts’ expectations of $0.41–$0.42.

Income fell 9% year-over-year to round $19 billion, under the anticipated $21 billion. Automotive income additionally dropped 20% amid decrease deliveries and worth cuts.

The corporate’s automobile deliveries declined 13% in comparison with Q1 2024, whereas manufacturing decreased 16%. In keeping with Tesla, the decline in manufacturing was attributable to an replace to 4 Mannequin Y manufacturing strains.

In distinction, Tesla’s power section noticed robust development, reporting a 67% year-over-year improve in income. Regulatory credit score income elevated to $595 million, up from $432 million a 12 months earlier.

In the course of the earnings name, Elon Musk introduced plans to scale back his involvement with the White Home DOGE workplace to focus extra on his enterprise.

“Beginning subsequent month, I might be allocating way more of my time to Tesla, now that the main work of building the Division of Authorities Effectivity is finished,” Musk mentioned.

Musk’s controversial function within the Trump administration has sparked protests, vandalism, and boycotts over the previous few months.

Tesla’s shares have dropped by round 41% to date this 12 months, in response to Yahoo Finance knowledge. The inventory surged practically 5% in after-hours buying and selling after Musk’s announcement.

Share this text