Utilizing Inflation Knowledge for Systematic Gold and Treasury Funding Methods

Introduction

Inflation considerably impacts the costs of gold and treasury bonds by way of numerous mechanisms. Gold is commonly considered as a hedge towards inflation, whereas treasury bonds exhibit a extra advanced relationship influenced by rates of interest and investor habits. This relationship between inflation, gold, and treasuries is nicely understood, however the actual query is whether or not we will systematically capitalize on it. On this article, we discover how inflation knowledge can be utilized to construct fastened revenue market timing buying and selling methods—and as our findings recommend, the reply is a particular sure.

Description of Analysis Issues/Questions

Inflation and asset efficiency have lengthy been focal factors in monetary economics. Traditionally, inflation has been proven to affect each Treasury bond and gold costs considerably. As an illustration, Barsky et al. (2021) spotlight that gold usually serves as a hedge towards inflation, with rising inflation expectations driving up gold costs. Equally, Rose (2014) underscores the inverse relationship between inflation and bond yields, the place increased inflation sometimes results in decrease bond costs. This physique of analysis collectively emphasizes the crucial position of inflation in shaping the efficiency of key financial property.

In gentle of those insights, this text goals to delve deeper into the mechanisms by way of which inflation impacts US treasury and gold costs, offering a complete evaluation and suggesting a couple of easy systematic market timing methods that exploit this advanced relationship.

Speculation Formation

Central banks’ financial insurance policies, significantly rates of interest and quantitative easing (QE), considerably affect inflation, gold, and treasury costs. The interaction of those components may be understood by way of numerous mechanisms that have an effect on asset pricing and market habits. Whereas central banks intention to stabilize the financial system by way of these insurance policies, the ensuing inflationary pressures and asset worth volatility can result in unintended penalties, comparable to market distortions and elevated financial uncertainty.

One commentary that market practitioners make about central banks’ insurance policies is that absolutely the stage of inflation doesn’t considerably impression the financial system (and central banks’ choices); quite, the change in inflation (fee of change – enhance or lower) does.

For instance, the Federal Reserve targets a 2% annual month-to-month inflation fee, roughly 0.2%. If this inflation fee stays optimistic every month however doesn’t speed up, the state of affairs stays secure, and the Fed has no cause to intervene.

Nonetheless, contemplate the next situation: the month-over-month (MoM) inflation fee for Could is 0.2%, June 0.4%, July 0.8%, and August 1.6%. This situation signifies an acceleration of inflation, which is problematic. In such circumstances, the Fed is compelled to reply, sometimes by way of elevating rates of interest. This era is unfavorable for bonds however may benefit gold as an inflation hedge. And this commentary is the idea for our funding technique.

Knowledge Sources, Assortment & Evaluation

The information set includes Change-Traded Funds (ETFs); equal indices are utilized earlier than ETFs exist.

The information pattern commences in 1981, which was chosen intentionally as a result of graduation of a strong bond bull market. Ought to our mannequin efficiently outperform the benchmark (buy-and-hold bond index), it could be a major achievement, given the problem posed by bond indices throughout this era, which exhibited exceptionally excessive Sharpe and Calmar ratios. This was primarily on account of rates of interest declining from roughly 10% to near-zero ranges.

Our thought of knowledge pattern ends in November 2024 and our funding universe consists of the next ETFs (and their index proxies earlier than the ETFs’ inceptions):

The method of acquiring the proper inflation knowledge is hard. After all, we have now the Shopper Worth Index for All City Customers: All Objects in U.S. Metropolis Common (CPIAUCSL) from FRED (Federal Reserve Financial institution of St. Louis). Nonetheless, this dataset is commonly recalculated, and it’s not a cut-off date. Subsequently, we determined to go to the supply, the U.S. Bureau of Labor Statistics, obtain all recordsdata with the precise/reported inflation bulletins and extract inflation knowledge as that they had been reported up to now since 1994. This fashion, we had the correct point-in-time knowledge (as reported) from 1994, and we used the FRED knowledge from 1981 to 1994.

The next chart illustrates the vanilla efficiency of thought of property through the abovementioned interval:

And, the danger & return desk accompanying the abovementioned determine is under.

A knowledge pattern overlaying greater than 40 years reveals that treasury bonds have been in a secular bull market whereas gold has comparatively struggled to maintain up towards fixed-income. The US Greenback (towards a basket of different currencies) didn’t transfer a lot and completed 40 years at roughly the identical stage because it began.

Affect of Inflation

Now, let’s assessment the efficiency of property in numerous financial regimes primarily based on our inflation measure. The choice rule is simple – when the month-to-month change in MoM inflation report is optimistic for two months in a row, then we change into the market regime by which we contemplate that inflation goes UP. When the month-to-month change in MoM inflation report is adverse for two months in a row, then we change into the market regime by which we contemplate that inflation goes DOWN. In all different circumstances, we retain the regime from the earlier month.

Let’s have an instance:

The reported inflation for January is +0.3%, February +0.3%, March +0.4%, April +0.5%, Could +0.5%. The change between February and January is 0%, between February and March is +0.1%, between March and April is 0.1%, and lastly, between April and Could is 0%. In our principle, whereas the excessive month-to-month inflation is just a little troubling for the FED (or any central financial institution), what’s considerably extra harmful is when the speed of change of the inflation is optimistic. The excessive January and February inflation (0.3% MoM, 3.6% annualized) is disagreeable however doesn’t require FED’s consideration. What’s dangerous is that if inflation accelerates -> March is +0.4%, April is +0.5%. This acceleration in inflation will in all probability trigger the FED to leap into motion, which is why we use 2 successive month-to-month accelerations as a set off for regime change in our mannequin. After all, the inflation knowledge are delayed, so we all know April’s inflation in Could, so the change is definitely recorded within the knowledge on the finish of Could. An identical logic is used for the sign change to the Inflation DOWN regime (with the other signal within the calculation, after all).

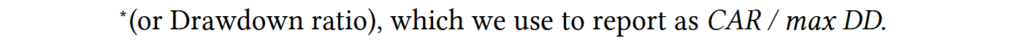

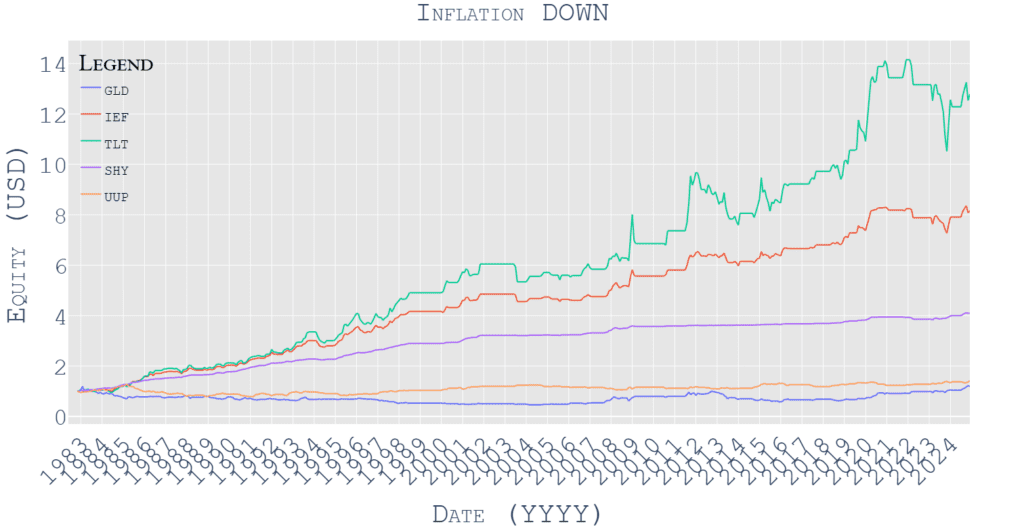

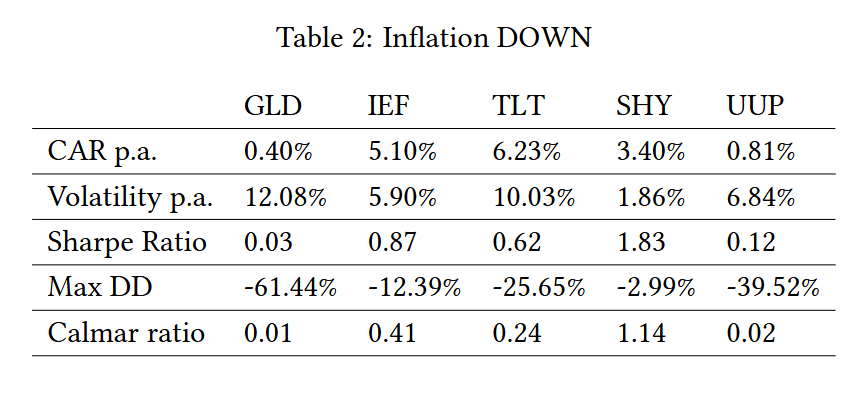

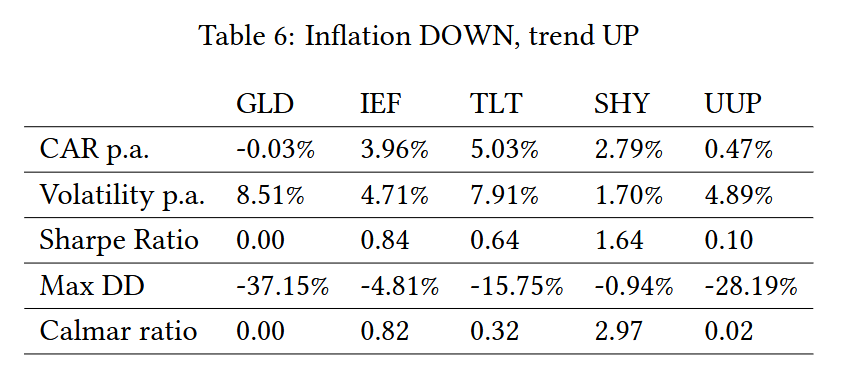

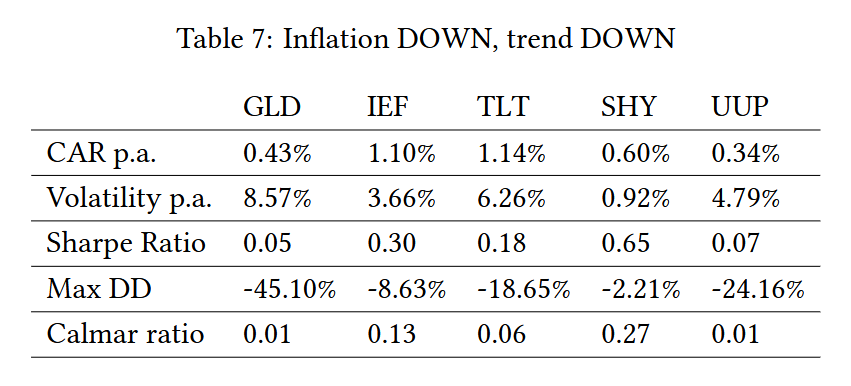

Then we have now 2 regimes – Inflation DOWN or Inflation UP and here’s what the efficiency of the chosen asset appears like in these regimes:

This part highlights that Inflation DOWN regime is extremely favorable for bonds, whereas accelerating inflation advantages gold and quick USD positions.

As inflation accelerates, the standard view posits that gold is a dependable hedge, usually appreciating as traders search to protect buying energy. Conversely, the efficiency of treasury bonds is extra advanced; increased inflation sometimes results in elevated rates of interest, which inversely have an effect on bond costs. Our easy evaluation confirms, that the literature is right.

Nonetheless, let’s transfer on as there are some enhancements that may be urged.

Momentum Inclusion

Persevering with our fast idea, we suggest enhancing the mannequin by incorporating a historic development part (1-month Momentum). The addition of the momentum filter ought to enhance the standard of the sign – if we’re within the Inflation DOWN regime and the Momentum indicators that treasury bonds have already got a optimistic efficiency, then the general return-risk ratio of the asset needs to be increased. The identical ought to work for the Inflation UP regime and property which are probably the most delicate to it. Altogether, we have now doable eventualities and we will discover them.

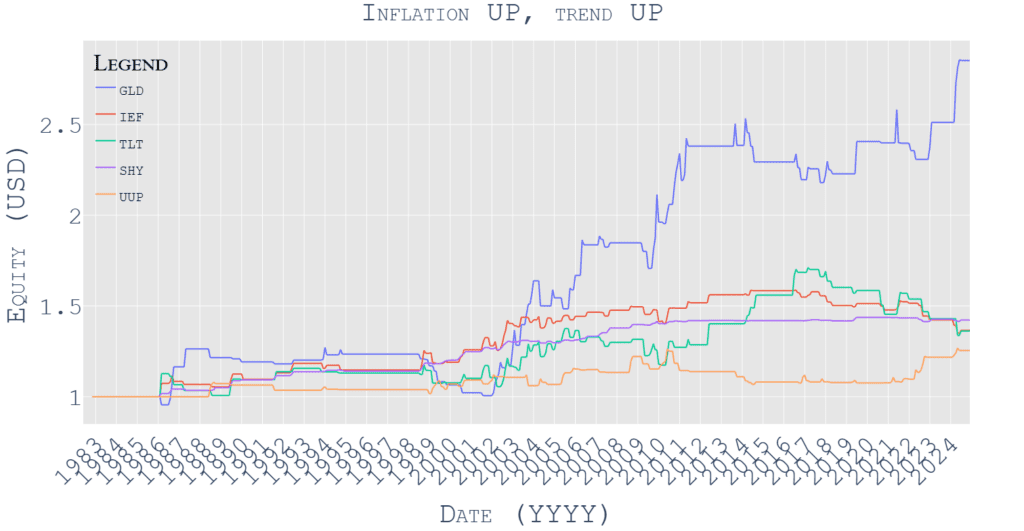

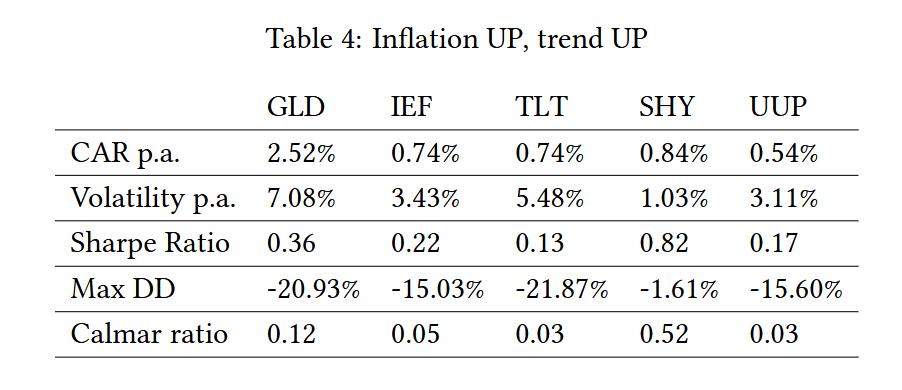

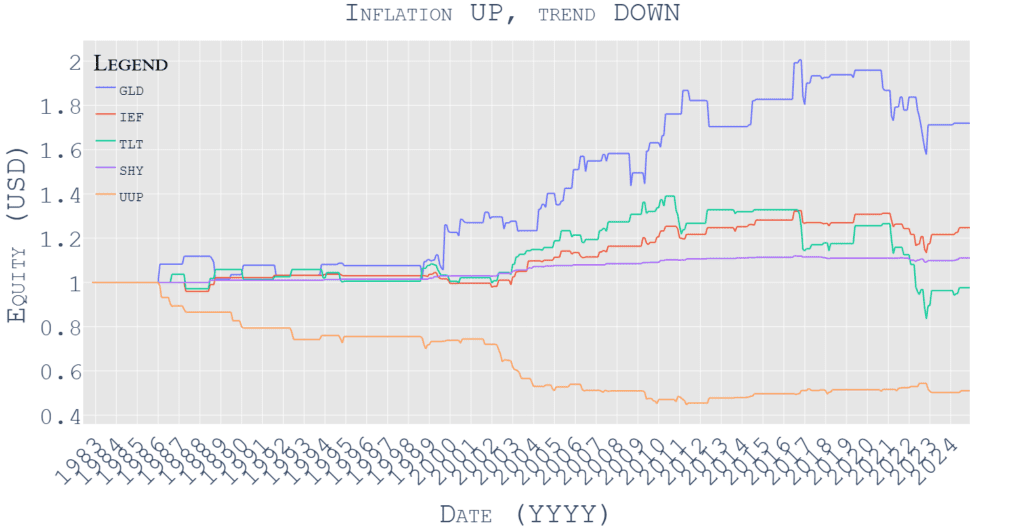

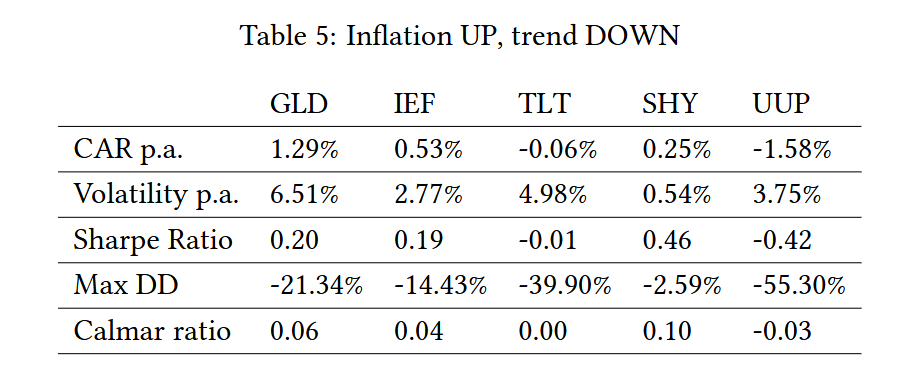

What are the obvious findings? When the inflation decelerates and treasury ETFs (IEF or TLT) have the optimistic efficiency, then that’s the very best regime for these funds. Then again, when the inflation accelerates, then we will maintain GLD within the optimistic development (inflation UP development UP regime) or quick USD (quick UUP ETF within the inflation UP development DOWN regime).

Ultimate Mannequin Buying and selling Technique

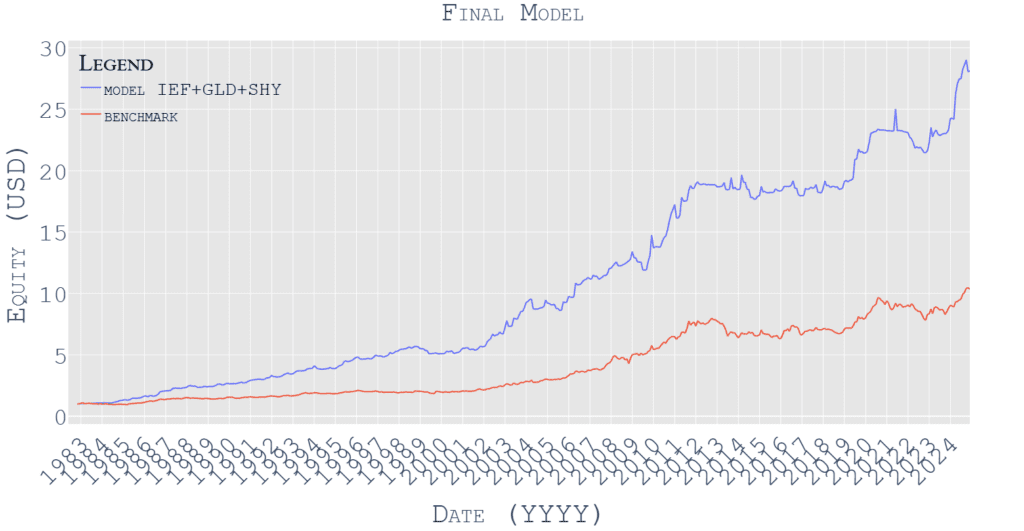

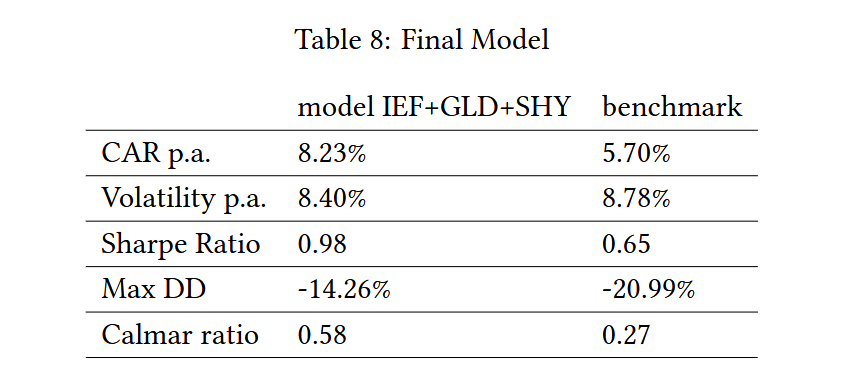

The addition of the momentum filter decreases the variety of months over which we maintain ETFs within the Inflation UP or DOWN regimes, and subsequently, we will have a money place (SHY) to enhance the efficiency if no different ETFs have favorable efficiency. Our proposed mannequin would, subsequently, maintain GLD within the Inflation UP Pattern UP regime, maintain IEF within the Inflation DOWN Pattern UP regime, and make investments into the money (SHY) in any other case.

We are able to evaluate the efficiency of the technique to its pure benchmark -> the equally weighted portfolio of IEF and GLD.

We see that with a easy choice of appropriate predictors, we will enhance whole returns significantly whereas sustaining satisfying threat parameters. Moreover, the Sharpe ratio, Calmar ratio, and efficiency of this technique are increased than, for instance, simply holding IEF, TLT, or some other ETF for the entire chosen interval.

In synthesizing these insights, our analysis goals to elucidate the mechanisms by way of which inflation influences asset lessons whereas contemplating the position of central financial institution insurance policies. The speculation posits that it isn’t merely absolutely the inflation stage that issues however its fee of change. This distinction is crucial; secure inflation could not provoke important market reactions, whereas accelerating inflation compels central banks to regulate financial coverage—sometimes leading to increased rates of interest that adversely have an effect on treasury costs however could bolster gold in its place funding. Our mannequin proposes a buying and selling technique capitalizing on these dynamics: holding gold throughout accelerating inflation whereas favoring treasury bonds in decelerating inflation environments. This strategy goals to boost risk-adjusted returns in comparison with conventional buy-and-hold methods.

In conclusion, our findings contribute to the prevailing literature by providing a complete framework for understanding the interaction between inflation and asset pricing. The proposed mannequin demonstrates that tactical asset allocation primarily based on inflationary indicators can yield superior returns whereas mitigating dangers related to financial volatility. As monetary markets evolve amidst altering financial situations, our analysis underscores the significance of adaptive funding methods that reply dynamically to macroeconomic indicators.

Creator: Cyril Dujava, Quant Analyst

Are you in search of extra methods to examine? Join our e-newsletter or go to our Weblog or Screener.

Do you need to study extra about Quantpedia Premium service? Examine how Quantpedia works, our mission and Premium pricing supply.

Do you need to study extra about Quantpedia Professional service? Examine its description, watch movies, assessment reporting capabilities and go to our pricing supply.

Are you in search of historic knowledge or backtesting platforms? Examine our listing of Algo Buying and selling Reductions.

Or comply with us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookConsult with a buddy