Key Takeaways

BlackRock has launched the iShares Bitcoin ETF on Cboe Canada.

The newly listed fund joins different iShares ETFs already buying and selling on the change.

Share this text

BlackRock Canada, the Canadian arm of the worldwide funding administration agency, introduced Monday the launch of its iShares Bitcoin ETF on Cboe Canada. The fund, buying and selling beneath the tickers IBIT (Canadian {dollars}) and IBIT.U (U.S. {dollars}), is designed to supply Canadian traders a regulated and accessible technique of gaining publicity to the world’s largest digital asset.

BlackRock’s new Bitcoin ETF adopts a funds-of-funds method, that means that it invests considerably or all of its belongings within the US-listed iShares Bitcoin Belief ETF, which in flip invests in and holds long-term Bitcoin. Traders can purchase shares of the ETF via commonplace brokerage accounts.

“The launch of the iShares Bitcoin ETF in Canada underscores BlackRock’s dedication to innovation and offering purchasers entry to an increasing world of investments,” stated Helen Hayes, Head of iShares Canada, BlackRock.

“The iShares Fund gives Canadian traders with a handy and cost-effective strategy to achieve publicity to Bitcoin and helps take away the operational and custody complexities of holding bitcoin straight,” she added.

The Bitcoin ETF joins seven different iShares merchandise already buying and selling on Cboe Canada. The change handles roughly 15% of all buying and selling quantity in Canadian listed securities. It’s additionally a go-to platform for ETFs from Canada’s largest issuers, Canadian Depositary Receipts, and numerous progress firms.

“Cboe has a historical past of bringing many first-of-their-kind merchandise to market, together with spot crypto ETFs in america, and we’re thrilled to proceed our management in innovation by itemizing BlackRock Canada’s IBIT ETF on Cboe Canada,” stated Rob Marrocco, World Head of ETF Listings at Cboe.

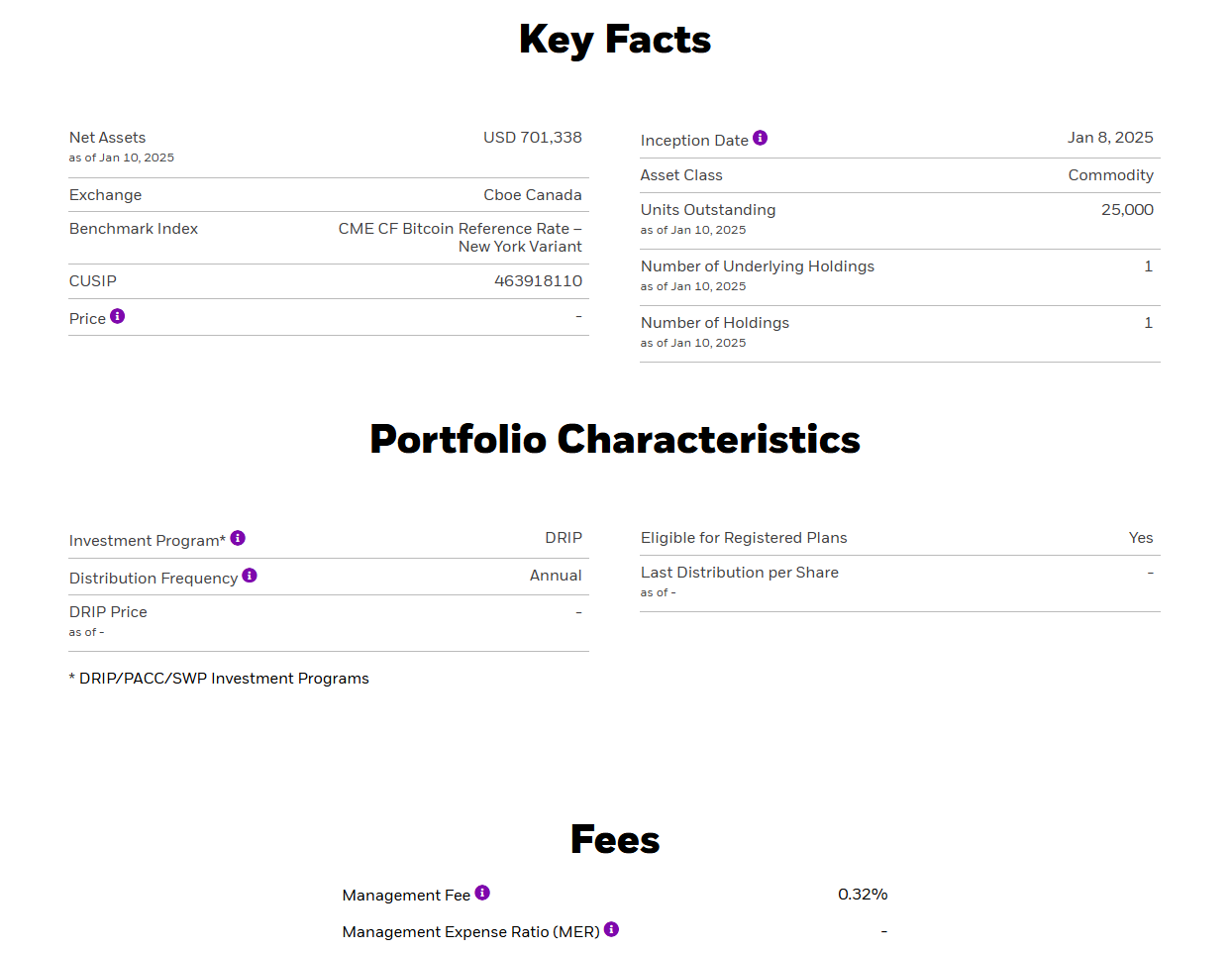

As of January 10, the Canada-listed iShares Bitcoin ETF had web belongings of round $701,338, with 25,000 items excellent. BlackRock fees a administration price of 0.32%.

Share this text