Merchants, I look ahead to sharing my prime concepts for the upcoming week, together with my exact entry and exit targets and explaining the precise setups and situations I’m on the lookout for.

So, with out additional ado, let’s bounce straight into it!

Starting with the most recent theme, Chinese language shares.

Now, I received’t go over the background surrounding the transfer, be it macro or technical, as I already did so intimately in my newest Inside Entry assembly. As a substitute, I’ll define the place I see the chance going ahead and lay out my plans.

Imply Reversion A+ Alternative

The Concept: Firstly, I’m wanting on the most overbought Chinese language inventory, judging by its vary growth and RSI. It’s vital to keep in mind that these Chinese language shares are breaking out of multi-year bases, are actual firms, and have immense tailwinds coming from Beijing’s measures. So, I’m not on the lookout for a “crash” kind transfer—only a imply reversion alternative.

The Inventory in Focus: As a result of vary, liquidity, and RSI, TIGR is the perfect inventory for a imply reversion alternative. Once more, it’s a actual firm right here with immense inflows and advantages from rotation into Chinese language shares. Nevertheless, with its RSI now within the mid-90s, it’s arrange virtually completely for a imply reversion commerce.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market components resembling liquidity, slippage and commissions.

The Plan: There are numerous situations and methods wherein this will play out. Every state of affairs has totally different gradings, i.e., A+, A-, and even A++. As I mentioned at nice size in Inside Entry, it’s vital to recreation plan every state of affairs and description IF/THEN statements.

For instance, IF TIGR gaps up on Monday, additional stretching its RSI, has one final push off the open and rapid rejection, THEN that’s A++, and I’ll look to be quick versus the HOD, explicitly focusing on a decrease excessive entry and consolidation breakdown / VWAP breakdown for an add.

Or, if TIGR gaps up on Monday and provides the hole again within the pre-market, I’d downgrade the transfer to A—and look to quick a decrease excessive / failed pre-market excessive try. Ifthe inventory holds weak beneath VWAP, I’d improve its score to A+ and measurement accordingly. These are simply two attainable situations. There are lots of extra, with totally different gradings and EV, which can influence my danger.

Different shares I will likely be watching intently, with an analogous plan, are FUTU and YINN.

Now, this theme will take up most, if not all, my consideration as a imply reversion alternative units up, adopted by loads of open-minded buying and selling alternatives after that.

So, with that being mentioned, listed here are simply two extra shares I’ve set alerts in.

Further Mentions:

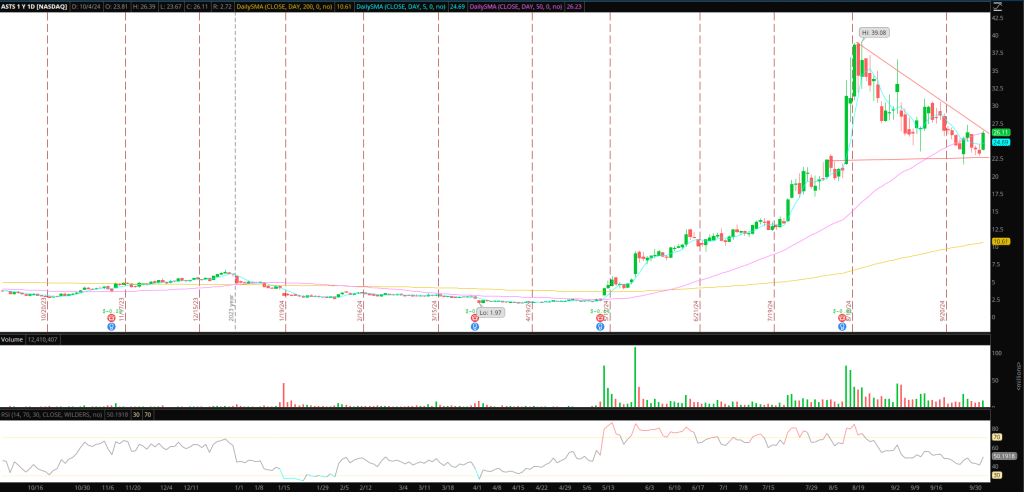

ASTS Consolidation Breakout

The Concept and Plan: Just like my earlier plan within the title, the inventory has digested its upmove and stabilized nicely above its rising 5-day SMA. After Friday’s motion, it seems prepared for a momentum transfer larger.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market components resembling liquidity, slippage and commissions.

I will likely be on the lookout for additional affirmation earlier than coming into lengthy for a swing. I need to see the inventory maintain above Friday’s excessive and its rising 50-day. If ASTS can spend time with RVOL, holding above that zone, I’ll look to enter with a LOD cease, focusing on a transfer towards $30 as goal 1.

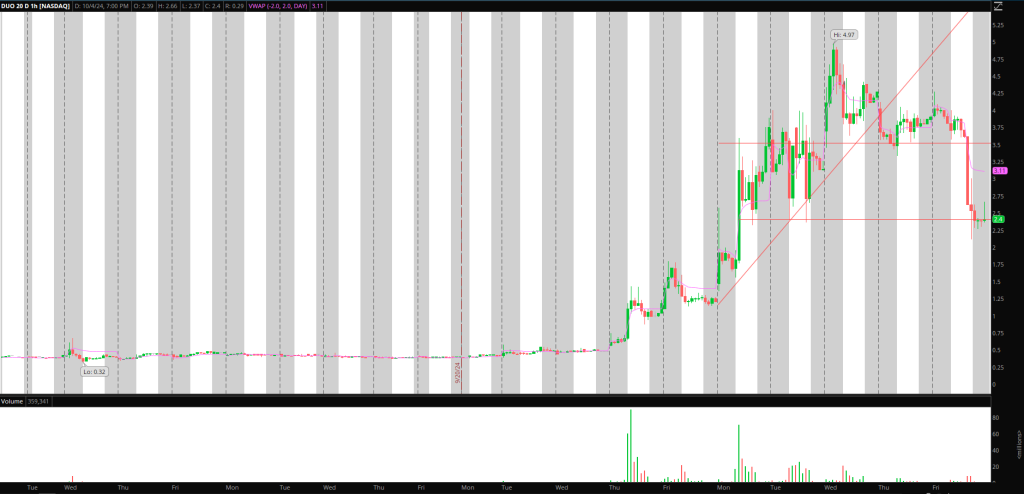

DUO Bottom Brief

The Concept and Plan: A number of choices had been introduced final week, and eventually, a personality change on Friday afternoon. I’m actually not seeking to chase weak point within the title. If it could possibly push again towards the $3.5 space of potential resistance, then I’d search for a brief, trailed towards decrease highs, focusing on a transfer towards $2.5 and $2.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market components resembling liquidity, slippage and commissions.

BENF Failed Comply with-By means of Brief

The Concept and Plan: I’m preserving it easy after Friday’s failure. If the inventory pushes again towards $1.9 and fails, I’ll search for a brief scalp that targets $1.6 – $1.5. I received’t watch the inventory. I’ll have alerts set, and in the event that they go off, I’ll pay nearer consideration to cost motion to react or disregard it.

*Please observe that the costs and different statistics on this web page are hypothetical, and don’t mirror the influence, if any, of sure market components resembling liquidity, slippage and commissions.

Get the SMB Swing Buying and selling Analysis Template Right here!

Vital Disclosures