Of the various chart patterns, the pinnacle and shoulders chart sample might be probably the most sophisticated to grasp.

Simply because it’s sophisticated to grasp doesn’t imply it’s unattainable to commerce.

Beneath, we’ll run by means of the Head and Shoulders sample, the way to spot it, and the way to commerce it. Let’s get began.

Contents

The pinnacle and shoulders are chart patterns that, when shaped, might point out that the value is able to reverse.

This sample is barely seen on the termination of an uptrend and is characterised by three distinct peaks or tops: a better peak (head) within the center and two decrease peaks (shoulders) on both facet.

The opposite key element is the “neckline,” which is drawn by connecting the bottom two factors between the peaks.

The neckline serves as a essential help stage after it’s shaped.

As soon as the value breaks under this stage, it may be traded as if it indicators a brand new downtrend.

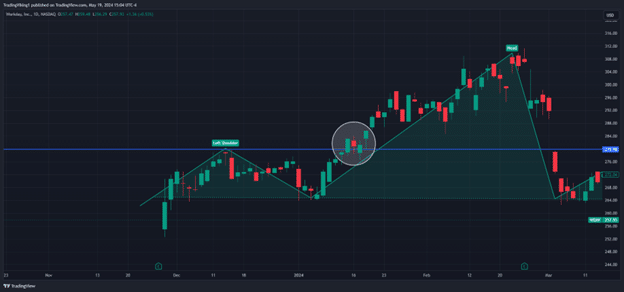

For instance, let’s check out Workday (WDAY) under:

As you may see, the value has been on an uptrend for a number of months heading into 2024.

It then dips and bounces across the $265 stage to type the left shoulder.

The value then rallies into the highs round $310 earlier than dropping again right down to that $265 stage after earnings.

This can be a second take a look at of that help stage, which has now shaped the pinnacle.

That is one other bounce from $265ish earlier than the value lastly breaks down by means of it and begins to commerce decrease.

The pinnacle and shoulder formation would have been efficiently arrange on that final take a look at of the help stage (Neckline) at $265.

Now that we now have a fundamental understanding of the pinnacle and shoulder sample let’s take a look at how we will spot it after which commerce it.

First, you need to establish shares which were in a sustained uptrend.

Since it is a reversal sample, we want a pattern to reverse.

Subsequent is to search for the formation of the left shoulder. Within the instance above, it’s the place the place the value has retraced to and bounced ($265 space).

Subsequent, you search for the formation of the pinnacle.

The pinnacle is shaped when the value resumes its upward pattern and finally falls again right down to the bounce level.

That is additionally its commerce, which might be mentioned within the subsequent part.

Lastly, we’re on the lookout for the formation of the suitable shoulder.

This shoulder is shaped When the value as soon as once more bounces off the help stage, however this bounce ought to exhaust someplace round the place the left shoulder did.

With this, the formation of the pinnacle and shoulders is full.

The final piece of data to tie this all collectively is the neckline.

Technically, you may draw the neckline at any level within the formation after the left shoulder is shaped.

That is tough this early on, although, as you haven’t any thought if it’s a head and shoulder or only a bounce.

Many merchants anticipate the formation of the left shoulder and head to attract within the neckline help.

Ready till this level does a number of issues: first, it confirms the neckline as a help stage, and second, it units up the remainder of the commerce and provides a while to plan an entry.

Sample Recognizing Instruments

A number of instruments out there now might help velocity up the educational curve for recognizing head and shoulders (or any chart sample).

Websites like Trendspider and CMLViz made a reputation for themselves by with the ability to mechanically detect chart patterns and let customers scan by means of them.

As well as, free websites like FinViz have a bit that lets customers scan for technical patterns, and now even brokers are catching up with instruments like Sample Identification by means of ThinkorSwim.

Whereas none of those choices are foolproof, they’re a good way to assist discover shares matching chart patterns and assist velocity up the educational curve to identify them your self.

Now that we’re all in control on the pinnacle and shoulders sample and the way to spot it, listed below are a number of methods you could commerce it:

Breakout Commerce

The breakout commerce is the usual head and shoulders commerce.

It’s executed by ready for the value to interrupt under the neckline for the commerce to be entered.

The cease lack of this commerce is usually set proper above the latest swing excessive (the suitable shoulder), and the revenue goal is the swing excessive on the pinnacle minus the swing excessive of the shoulder.

So, within the workday instance, the entry would have been contained in the white circle with a cease round $280 above the shoulder.

The revenue goal can be 30 factors (The pinnacle of $310 – the suitable shoulder of $280).

10X Your Choices Buying and selling

The Bounce Commerce

The second kind of commerce doable throughout the head and shoulder is the bounce commerce.

This can be a quick commerce seeking to play the formation of the pinnacle.

The entry on this commerce is when the value closes above the excessive of the left shoulder, and the cease loss is under the neckline.

When it comes to revenue, there are two fundamental strategies right here:

The primary is to take the gap from the neckline to the left shoulder and use that because the variety of factors to search for.

The second is to run a trailing cease to take the utmost quantity of the transfer doable.

Choices

The pinnacle and shoulder sample lends itself to utilizing choices fairly effectively.

A daily put or name possibility may suffice in the event you take the breakout or bounce commerce. As is common with bare calls, although, theta decay works towards you, and your transfer might be proper, however your timing is mistaken.

This makes vertical spreads, ratio spreads, and much more unique spreads just like the Zebra technique extra helpful right here.

Choices are a good way to leverage our potential achieve and cap your potential loss on these trades, assuming you purchase/promote with sufficient time.

The pinnacle and shoulders sample is a robust pattern reversal sample that enables customers to identify and commerce bearish reversals with each an outlined cease and a location for a take revenue.

Studying to identify and commerce them successfully might help increase profitability in shares trending down or assist hold you out of shares that look bearish.

Using choices might be a good way to additional leverage up the pinnacle and shoulders potential whereas maintaining your threat outlined.

Bear in mind to maintain your threat outlined whether or not you’re buying and selling the common breakout commerce or seeking to catch the bounce commerce.

These patterns are highly effective however can all the time reverse on you.

We hope you loved this text on the heads and shoulders chart sample.

When you’ve got any questions, please ship an e mail or depart a remark under.

Commerce protected!

Disclaimer: The data above is for instructional functions solely and shouldn’t be handled as funding recommendation. The technique offered wouldn’t be appropriate for traders who are usually not conversant in change traded choices. Any readers on this technique ought to do their very own analysis and search recommendation from a licensed monetary adviser.