Justin Paget

Homebuying within the U.S. will stay sluggish till a mix of stronger revenue progress and decrease mortgage charges – nearer to six% – helps restore affordability within the housing market, Fannie Mae (OTCQB:FNMA) predicted.

Granted, mortgage charges have been making lower-highs (i.e., trending down) since late final yr, as bond-market buyers “now seem to count on slower paths for financial progress and inflation,” famous Mark Palim, vice chairman and deputy chief economist at Fannie Mae. The contract price on a 30-year mounted mortgage was 6.49% at Aug. 15, down from the cycle peak of seven.80% at Oct. 25, 2023.

“On its face, the decrease price setting must be good for house gross sales by serving to loosen the grip of the so-called ‘lock-in impact,’ along with aiding affordability extra usually,” Palim stated. Nonetheless, he added, mortgage functions, listings views and different high-frequency knowledge “counsel that many potential homebuyers stay reluctant to make the leap.” That’s very true as house value progress continues to outpace that of incomes.

Curiously, mortgage refinancing is experiencing a notable rebound as borrowing prices ebb, whereas buy demand stays depressed. In a current X submit, Renaissance Macro Analysis stated that refi has surged 118% from a yr in the past, whereas mortgage functions for house purchases retreated about 8%.

Even with the current slide in mortgage charges, Fannie Mae’s (OTCQB:FNMA) Financial and Strategic Analysis Group expects whole house gross sales to come back in decrease than beforehand forecast (at 4.78M items) by the rest of 2024, after which not choose up meaningfully till additional out in 2025 (at 5.19M items). It forecasts mortgage charges to common 6.4% by the tip of this yr and 5.9% by the tip of subsequent yr.

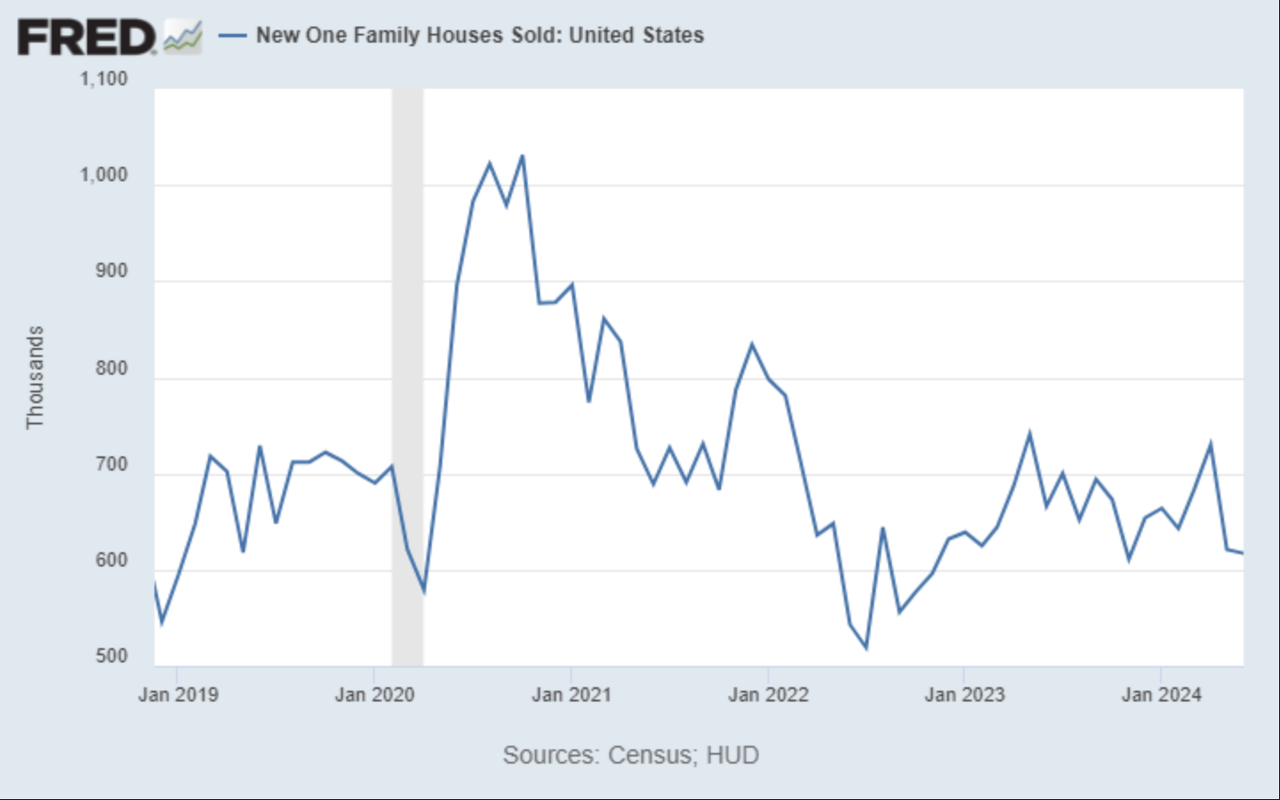

The ESR Group continues to understand higher energy in new house gross sales in comparison with present house gross sales, on condition that strong margins for homebuilders are anticipated to result in concessions within the upcoming quarters. Nonetheless, a short-term slowdown in new begins is anticipated because of the elevated variety of houses already below building, which is more likely to postpone new tasks till the prevailing stock is bought.

Mortgage charges stay fairly elevated relative to earlier than the Federal Reserve began its rate-hiking marketing campaign in March 2022. However that doesn’t appear to hassle D.R. Horton (NYSE:DHI), the U.S.’s largest homebuilder, due to a mix of still-limited provide and favorable demographics.

Likewise, Lennar’s (NYSE:LEN) fiscal Q2 earnings, posted in mid-June, surpassed the common analyst estimate, as gross sales incentives helped to buoy orders and deliveries within the three-month interval. PulteGroup’s (NYSE:PHM) Q2 earnings additionally topped Wall Avenue expectations, helped by will increase in closings, common gross sales value and gross margin.

Different homebuilders: KB Dwelling (NYSE:KBH), Toll Brothers (NYSE:TOL), Beazer Properties (NYSE:BZH), Tri Pointe Properties (NYSE:TPH), NVR (NYSE:NVR), Taylor Morrison Dwelling (NYSE:TMHC), Meritage Properties (NYSE:MTH).

Actual property brokerages: Redfin (NASDAQ:RDFN), Zillow (NASDAQ:Z) (NASDAQ:ZG), Compass (NYSE:COMP), Opendoor Applied sciences (NASDAQ:OPEN), Re/Max (RMAX).