Meta Platforms (META) is arguably the perfect Magnificent Seven inventory proper now and presents a shopping for alternative, for my part. The social media firm’s advert income and consumer base proceed to develop, and the valuation leaves loads of room for error. The current earnings report and long-term efficiency make me bullish on the inventory.

Web Revenue Surges With out Job Cuts

Meta Platforms’ web earnings has been hovering in current quarters, which has prompted the social media large to supply its first quarterly dividend this 12 months. Earnings continued in that course, with a 73% year-over-year improve within the second quarter.

Effectivity has been a key contributor to the corporate’s rising earnings. That’s code for firing extra staff, however important cuts weren’t current in this quarter. Whereas Q1 2024 featured a ten% year-over-year decline in headcount, the second quarter solely noticed a 1% year-over-year decline on this space.

Meta Platforms’ skill to retain employees whereas delivering strong web earnings development can place it effectively sooner or later. A draw back to firing many employees is the lack of expertise and the difficulties of changing individuals who left. Seeing that draw back much less current within the second quarter whereas web earnings continued to soar is an encouraging growth.

Day by day Energetic Customers Proceed to Improve

Fb, Instagram, and WhatsApp are three of the prime social media platforms — all owned by Meta. Despite the fact that these platforms are well-known, they proceed to draw new customers. Meta Platforms reported a 7% year-over-year improve in each day energetic customers throughout its household of apps. On account of excessive consumer development, the corporate closed out the quarter with 3.27 billion each day energetic customers.

A rising consumer base permits Meta Platforms to offer extra advert placements for firms, small companies, and influencers. These additional advert spots can assist Meta Platforms ship elevated income development for a number of years.

A Good Valuation

A inventory’s valuation is a key part of the evaluation after contemplating the basics. Meta Platforms actually delivers with a 27.5x P/E ratio. There are many corporations with the same valuation that aren’t delivering 73% year-over-year web earnings development for his or her traders.

Alphabet (GOOG) (GOOGL) is the one Magnificent Seven inventory that trades at a decrease valuation, and its year-over-year web earnings development pales as compared to Meta Platforms. Moreover, Fb’s father or mother firm ought to proceed to learn from rising income and earnings, which ought to convey down the P/E ratio much more.

Story continues

It’s additionally good to notice that Meta Platforms’ web earnings development has outpaced its year-to-date inventory features. Meta Platforms inventory is up 49% year-to-date, which is supported by rising earnings.

A Dividend Development Story within the Works

Meta Platforms isn’t solely catering to development traders. The corporate’s current dividend program now makes it an interesting choose for dividend development traders. Whereas Meta Platforms solely has a 0.37% yield, it has the monetary development and money place to help an annualized double-digit dividend development price for a few years.

As an example, Meta Platforms closed out the quarter with $58.08 billion in money. It has loads of sources to help dividend hikes over time, however Meta Platforms doesn’t even should faucet into these reserves for the dividend program.

The corporate distributed $1.27 billion to its traders as dividend funds this quarter. Throughout the identical quarter, Meta Platforms allotted $6.32 billion towards its inventory buyback. Shifting among the buyback funds to dividend distributions is enough to hike the dividend by a minimum of 10% per 12 months for a number of years, but it surely’s higher for tax functions that the capital goes towards inventory buybacks.

Whereas we’ve coated Meta Platforms’ web earnings development price, the corporate’s whole GAAP revenue got here in at $13.5 billion this quarter. That’s sufficient money to help elevated dividends within the years forward. Thus, Meta Platforms has the making of a dividend development inventory that outperforms the market whereas elevating its dividend significantly over time. That setup ought to entice many dividend traders because it turns into extra obvious.

Is META Inventory a Purchase, In line with Analysts?

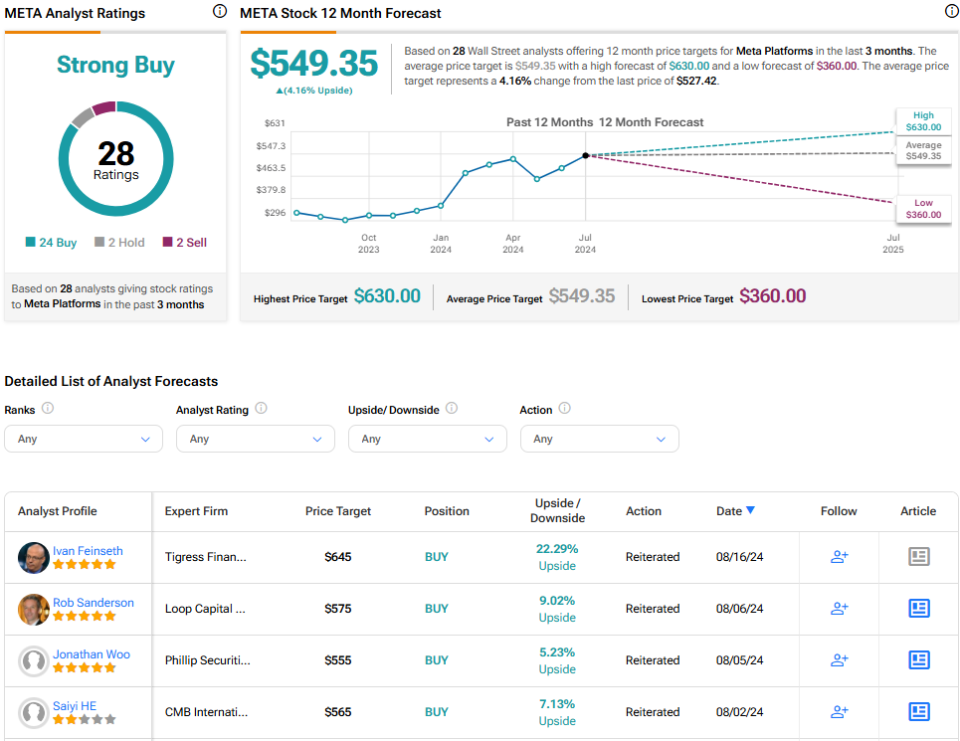

Meta Platforms is presently rated as a Sturdy Purchase on TipRanks based mostly on 24 Buys, two Holds, and two Promote scores assigned previously three months. The common META inventory worth goal suggests 4.2% upside from present ranges, however that’s a mirrored image of Meta Platforms’ current inventory features. The best worth goal of $645 per share, which was assigned as we speak, suggests that the inventory can achieve a further 22% from present ranges.

See extra META analyst scores

The Backside Line on Meta Platforms Inventory

Meta Platforms has delivered unbelievable income and web earnings development for its traders in current quarters. Additional, increasing revenue margins have trimmed the inventory’s P/E ratio, even because it has continued to outperform the market. Moreover, Meta Platforms continues to develop its consumer base, which can help larger income sooner or later.

It was encouraging to see Meta Platforms develop its web earnings by 73% year-over-year whereas retaining most of its staff. It’s an indication that the corporate doesn’t should depend on job cuts to generate extra earnings. Many analysts consider Meta Platforms can proceed to ship features for long-term traders, and I’m in settlement with them.

Disclosure