Oh My! I Purchased A Fallacious Inventory! – Investigation of Lead-Lag Impact in Simply-Mistyped Tickers

Our new research goals to analyze the lead-lag impact between outstanding, well known shares and smaller, less-known shares with related ticker symbols (for instance, TSLA / TLSA), a phenomenon that has acquired restricted consideration in monetary literature. The motivation behind this exploration stems from the speculation that buyers, particularly retail buyers, might inadvertently commerce on less-known shares attributable to ticker image confusion, thereby impacting their value actions in a way that correlates with the main shares. By analyzing this potential misidentification impact, our analysis seeks to shed some gentle on this fascinating issue.

Investigating misspellings between inventory tickers is an intriguing space of analysis that intersects finance, linguistics, psychology, and economics. Understanding this impact might present useful insights and translate into methods that exploit such inefficiencies.

Background and associated literature

A ticker image (also referred to as a inventory image) is a novel abbreviation used to establish publicly traded shares of a selected firm on a specific inventory market. These symbols function shorthand for buyers to establish and commerce shares. Whereas the U.S. Securities and Alternate Fee (S.E.C.) grants corporations cheap discretion in deciding on their ticker symbols, there are pointers to observe. The chosen image have to be unique (not replicating one other firm’s ticker) and acceptable.

Firms attempt to provide you with tickers which can be simple to recollect and distinctive. Nonetheless, as a result of excessive variety of corporations listed within the U.S., many corporations have tickers that could be simple to confuse.

Present Literature

The primary concise article behind the event of our analysis was Typo Buying and selling Evaluation from Uncommon Whales (part of “Typo Buying and selling,” a.ok.a. the Levenshtein Basket):

They start by stating that the arrival of zero-commission buying and selling and unprecedented accessibility to market data by means of social media remodeled the world of buying and selling and investing, which particularly “exploded” in 2020-2021 with the COVID crash and the primary meme rally.

However they additional transfer into the subject of our curiosity right now: “typo buying and selling.”

In addition they broadly consult with Levenshtein distance, a string metric measuring the variations between two sequences; between two phrases, it’s the minimal variety of single-character edits (insertions, deletions, or substitutions) required to alter one phrase into one other.

They supply believable explanations for which this will likely work from elementary PoV (point-of-view):

As soon as the information that pushes the retail inventory increased is launched, this shopping for strain leaks into shares throughout the Levenshtein basket that’s sometimes and in any other case uncorrelated.

Smartphone buying and selling encourages dangerous conduct, unintentionally involving buying and selling completely different securities (e.g., comparatively huge fingers on a small keyboard).

The opposite attainable issues to take up for consideration are:

Asian buyers can also have problem differentiating between tickers, as their markets depend on numbers as an alternative of the US market’s customized of letters for his or her inventory tickers.

Title and ticker confusion is extra widespread than the “fats finger trades” difficulty when the incorrect shares are purchased attributable to an by accident mistyped key. It is a recurring theme in in style monetary shops that attempt to inform about bombastic subjects and sensations.

There are additionally many in style finance articles, however underneath the quilt, there is likely to be some relevant and testable issues. The abstract of the paper from two professors on the Rutgers College of Enterprise-Camden, in a forthcoming difficulty of the Journal of Monetary Markets, discovered that greater than half of listed US corporations share a “significant half” of their names or tickers with one other agency, typically in a separate business and with a dramatically completely different market capitalization.

Of that group, there are round 250 firm pairs the place the opportunity of confusion is especially excessive, and 1 / 4 of those confirmed statistically vital similarities in buying and selling patterns that may solely be defined by circumstances of mistaken identification. By their estimates, the trades made by mistake, on common, price buyers $1.1M per pair per yr in transaction prices.

Nonetheless, our aim is to not research intraday or every day drifts in shares brought on by typo buying and selling in case there may be some notable occasion within the main shares. We’re extra fascinated about learning whether or not there’s a long-term drift within the mistyped shares (for instance, TLSA) if the main shares (for instance, TSLA) carry out effectively. Due to this fact, our research is extra akin to papers that debate linkages amongst associated shares.

One such associated paper is by Hulley, Liu, and Phua, 2024, who of their Investor Search and Asset Costs demonstrates {that a} momentum portfolio technique primarily based on agency relatedness, recognized by means of EDGAR co-searches, predicts future returns. These outcomes are sturdy to controls for agency traits, returns from different spillover momentum components, and recognized asset pricing anomalies. This robustness means that the EDGAR Co-search (EC) issue reveals distinctive data not captured by conventional relatedness measures. Importantly, EC issue returns can clarify these primarily based on shared analyst protection, implying that EC encompasses the data contained inside analyst networks.

It really works since corporations can have elementary similarities and relatedness, similar to working in the identical geographic space and industries, being clients/suppliers, and so on. Understanding these relatedness has implications for cross-asset return predictability as a result of data can movement by means of these linkages sluggishly.

We will point out extra examples from a household of wealthy lead-lag relationships and results. To checklist some extra to maintain observe of, we will level you to our earlier in-house research Evaluating Lengthy-Time period Efficiency of Equities, Bonds, and Commodities Relative to Energy of the US Greenback, the place we carried out the cross-asset evaluation to check the impression of the US Greenback’s energy or weak point on the efficiency of different asset courses, notably US equities, US treasury bonds, and commodities.

And ultimately, just a few extra examples:

Lead-lag relationship between analyst-connected shares, represented by Shared Analyst Protection: Unifying Momentum Spillover Results (Ali and Hirshleifer, 2019):

By figuring out agency connections by means of shared analyst protection, the authors discover {that a} connected-firm (CF) momentum issue generates a month-to-month alpha of 1.68% (t = 9.67).

Company Fairness Possession and Anticipated Inventory Returns from (Li, Tang, Yan, 2016):

They examine the cross-sectional predictive relations between inventory returns of two public corporations, with one agency, the dad or mum, proudly owning partial fairness of the opposite, the subsidiary, and discover that prime previous returns of the subsidiary (dad or mum) predict excessive future returns of the dad or mum (subsidiary)

Conceptualization of Our Research

So, our aim is to discover pairs knowledge of some chosen, typically mistakenly purchased and bought inventory and examine if there’s a lead-lag impact. All inspirations for tickers, their preliminary feasibility testing, and both inclusion or exclusion are from the articles talked about within the earlier chapter.

The checklist of potential candidates collected utilizing earlier articles and papers was then evaluated for suitability for inclusion (Widespread title/ticker mix-ups from Quartz).

Lots of our candidates had been discarded (“kicked out”) as a result of they

had been solely newly created ETFs (with few traded days, therefore the virtually non-existent knowledge pattern),

ones introduced out,

taken non-public or

relegated to pink sheets (OTC) [did not meet regulatory requirements from NASDAQ, for example, such as a price of $1 at least),

penny stocks.

Some of the proposed alternatives (for example, ES [stock] / ES [futures]) had been scrapped (presumably as a result of it’s a cross-asset relationship that we didn’t wish to pursue and endure additional in the meanwhile).

Information

The info pattern is 31.5.2019 – 31.3.2024, as the primary date is of the union from the dates of all knowledge obtainable for all shares.

We checked many of the shares by means of Yahoo Finance with syntax https://finance.yahoo.com/lookup?s={{TICKER}} (the place {{TICKER}} is, after all, changed with the real-world candidate).

After feasibility due diligence, we collect historic inventory ticker every day knowledge from YF and filter and pattern it for EOM (finish of month) afterward.

Our speculation is that bigger corporations (larger market-cap) lead smaller corporations (smaller market-cap).

AAPLApple Inc.HPE

Hewlett Packard Enterprise Firm

RCMR1 RCM Inc.AMSWA

SNAPSnap Inc.ZM

Zoom Video Communications, Inc.

lead(s [stocks])

(Simply surprise what number of you recognize … and let’s evaluate this checklist to the second choice.)

Tiziana Life Sciences Ltd

FORD

AAP

HP

Helmerich & Payne, Inc.

RCMT

AMS

American Shared Hospital Companies

SNA

ZI

ZoomInfo Applied sciences Inc.

lag[gards; lagging stocks]

And complimentary for comparability functions, we downloaded knowledge additionally for: SPY (SPDR S&P 500 ETF).

Lead-Lag Relationship

So, let’s take a better take a look at whether or not additionally it is financially worthwhile to implement some type of buying and selling technique which may profit from these (expensive) errors, typically left unrecognized.

As defined a little bit bit earlier earlier than, we take “extra well-known” (quantified by massive market-cap) inventory and evaluate it to “not so well-known” (smaller market-cap) inventory, with the belief of lead-lag relationship: so when the “bigger, larger” inventory strikes (for the sake of simplicity, now both up or down, whatever the amplitude of transfer) the transfer can be later additionally propagated in “much less recognized, typically mistakenly typed” inventory.

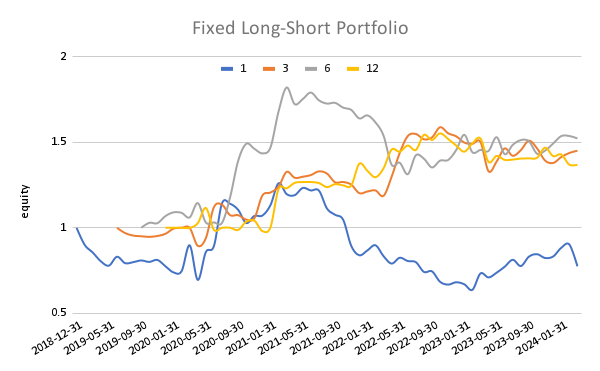

We use EOM knowledge about shares and research the efficiency of main shares on 1M, 3M, 6M, and 12M interval. If main inventory has a optimistic X-month efficiency (momentum) on the finish of the month, we purchase lagging inventory into the portfolio for the next month. Alternatively, if main inventory has a unfavourable X-month efficiency (momentum) on the finish of the month, we promote quick lagging inventory into the portfolio for the next month.

We’ve got two sorts of weighting:

1/ proportional (fractions) – the place you’re taking a portion of lagging shares n that ought to be within the lengthy leg of the portfolio (as a result of their main shares have a optimistic efficiency) and weight it proportionally as 1/n (so that you might need no shares occurring in some months, or precisely 1/8 for every inventory). Afterward, you’re taking a portion of lagging shares m that ought to be within the quick leg of the portfolio (as a result of their main shares have a unfavourable efficiency) and weight it proportionally as 1/m.2/ mounted – at all times 1/8 for every lagging inventory within the portfolio, regardless of if it’s within the lengthy or quick leg of the portfolio

Firstly, let’s concentrate on long-only methods, which is extra handy for retail buyers. Later, we may even have a little bit of a glance into the long-short technique variants.

Following are fairness curves graphs and our quasi-standard desk reporting of most essential efficiency metrics:

The mounted long-only portfolio (1/8 weight allotted to every lagging inventory when chief inventory has a optimistic X-month efficiency) performs satisfactorily, aside from a 6-month lag. Sadly, regardless that the efficiency of the long-only technique is optimistic, it doesn’t beat SPY’s efficiency on a risk-adjusted foundation over the identical interval.

Proportional weighting produces outcomes that beat index investing, though with increased volatility, unfavorable Sharpe ratios, and maximal drawdown.

Now, compared to the checklist: SPY gained virtually 20% yearly throughout the aforementioned interval, with favorable danger parameters beating out our proposed variants. Lengthy-only methods don’t seem like a path to outperform the passive market (no less than on this restricted pattern).

Now, let’s evaluate the efficiency of long-short methods, that use the mounted and likewise proportional weighting scheme.

Lengthy-short methods that use proportional weighting are fairly risky as, in some circumstances, only one or 2 shares are in a brief (or lengthy) leg of the portfolio in any specific month. Due to this fact, their danger contribution is substantial. Lengthy-short methods that use mounted weighting are considerably much less dangerous. Moreover, all medium to long-term sorting intervals (3M, 6M, 12M) provide an fascinating efficiency and Sharpe ratio for a market-neutral fairness long-short issue technique.

As talked about, this text ought to serve simply as a high-level overview of the lead-lag impact in misspelled (mistyped) shares. Sadly, the drawback is that we have now a small pattern (8 pairs), which was arbitrarily chosen, and there is likely to be vital subjectivity within the course of. Our backtest interval can also be considerably restricted.

What ought to be the subsequent steps? Our curiosity can be turned in direction of extending the pattern of the pairs by systematizing the collection of pairs. Moreover, we can be on the lookout for a approach to lengthen the backtest interval to see the impact’s efficiency over an extended historical past. Nonetheless, even on this small universe, our article reveals that there undoubtedly is a possible to use the proposed lead-lag relationships, and this impact justifies additional research.

Writer: Cyril Dujava, Quant Analyst, Quantpedia

Are you on the lookout for extra methods to examine? Join our publication or go to our Weblog or Screener.

Do you wish to study extra about Quantpedia Premium service? Test how Quantpedia works, our mission and Premium pricing provide.

Do you wish to study extra about Quantpedia Professional service? Test its description, watch movies, evaluate reporting capabilities and go to our pricing provide.

Are you on the lookout for historic knowledge or backtesting platforms? Test our checklist of Algo Buying and selling Reductions.

Or observe us on:

Fb Group, Fb Web page, Twitter, Linkedin, Medium or Youtube

Share onLinkedInTwitterFacebookConsult with a good friend