Userba011d64_201/iStock through Getty Photos

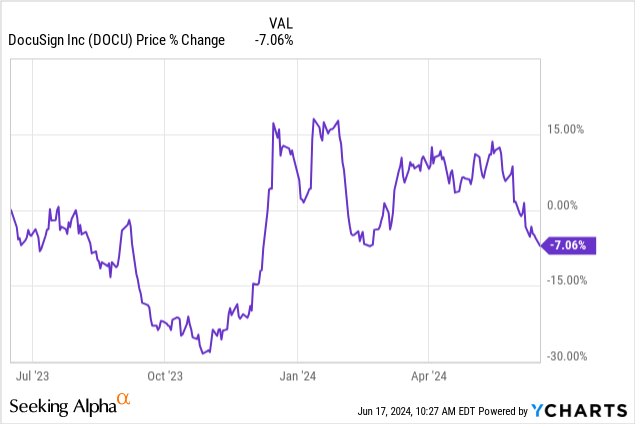

DocuSign (NASDAQ:DOCU) reported higher than anticipated first fiscal quarter outcomes, which had been launched on June 6, 2024. The e-Signature chief reported slowing top-line development, which was anticipated, and likewise revealed persistent dangers to its greenback web retention fee, a key efficiency metric for software program corporations. Though DocuSign is dealing with challenges when it comes to buyer monetization, I consider the e-Signature firm might be a gorgeous funding as a result of its sturdy free money flows and excessive margins. Within the first fiscal quarter, DocuSign achieved but once more a 30%+ free money stream margin and whereas shares should not a totally discount, I consider it’s price holding on to shares of the e-Signature firm.

Earlier ranking

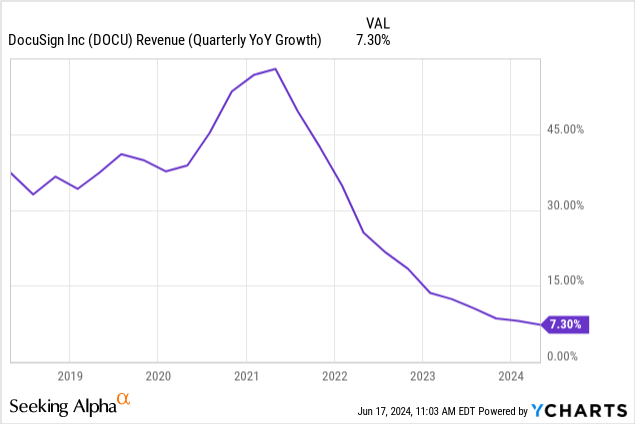

I rated shares of DocuSign to carry in November 2023 as a result of persistent greenback web retention dangers and weakening buyer monetization, which has largely performed out the best way that I predicted. Within the first fiscal quarter, DocuSign generated solely 7% top-line development, extending its streak of successively slowing income development, partly as a result of clients are extra discriminatory with their software program spending. Nonetheless, DocuSign is exceptionally free money stream worthwhile, which limits the draw back, in my view.

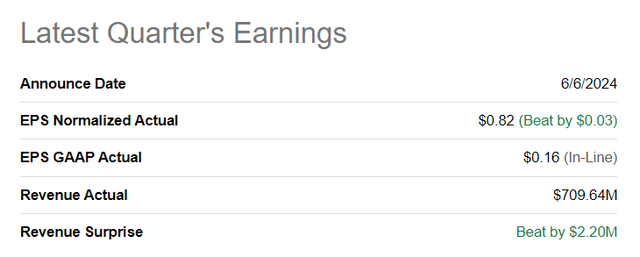

DocuSign beat the Avenue’s expectations for FQ1’25

The e-Signature chief reported first fiscal quarter earnings at the start of June, which resulted in a high and bottom-line beat: DocuSign had $0.82 per-share in adjusted earnings on revenues of $710M. Earnings beat by a small margin of $0.03 per-share, whereas revenues got here in additional than $2M above consensus expectations.

Looking for Alpha

DocuSign’s core worth proposition and greenback web retention dangers

DocuSign’s core product providing is its e-Signature resolution that permits its clients to decentralize settlement processes and shortly and cost-effectively signal contracts and agreements between a number of contract events. DocuSign additionally provides complimentary companies that enable corporations to streamline enterprise processes, resembling contract lifecycle administration, which helps corporations to maintain monitor of contracts and customise agreements on the click on of a button.

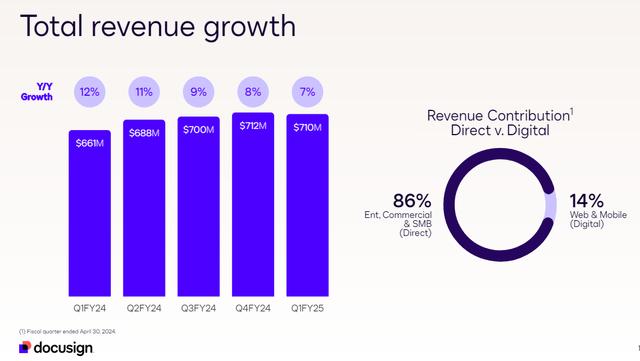

DocuSign generated $710M in revenues within the first-quarter, displaying a year-over-year development fee of seven% which marked the fourth straight quarter of income deceleration for the software program firm within the final 12 months. The excellent news is that DocuSign’s buyer base remains to be rising – the software program agency had 1.56M clients on its platform, displaying an 11% year-over-year development fee.

DocuSign

On the identical time, there are income dangers for DocuSign and these dangers have been mirrored in a moderating top-line development, particularly because the pandemic.

DocuSign’s downside is that current clients spend much less cash on the platform. This spending may be measures by a determine referred to as greenback web retention, which is measures how shortly a software program firm is rising its revenues organically. Previously, DocuSign’s dollar-based web retention fee has fallen, and web retention dangers particularly have been a purpose why I adopted a maintain ranking for shares of DocuSign in This fall’23.

In the newest quarter, DocuSign’s dollar-based web retention fee was 99%, displaying a 1 PP improve over the earlier quarter. Nonetheless, a retention fee under 100% nonetheless signifies that clients should not growing their spending, which is able to stay a threat for DocuSign going ahead. Provided that DocuSign had been to develop its dollar-based web retention to a fee of 100% or, ideally, greater than I’d, I think about a ranking improve to purchase.

Robust free money stream offsetting retention dangers

DocuSign is a really free money flow-profitable software program firm and generated $232M in free money stream simply within the final quarter. From a margin viewpoint, DocuSign is doing properly regardless of dealing with downward strain on its income development and web retention fee: the corporate stored 33 cents for each greenback it introduced in free money stream within the first fiscal quarter. Whereas the free money stream margin did not change a lot on a year-over-year foundation (+1 PP Y/Y), DocuSign nonetheless squeezed out 8% Y/Y free money stream development.

$ in M

Q1’24

Q2’24

Q3’24

This fall’24

Q1’25

Y/Y Progress

Whole Income

$661

$688

$700

$712

$710

7%

Free Money Circulation

$215

$184

$240

$249

$232

8%

Free Money Circulation Margin

32%

27%

34%

35%

33%

–

Click on to enlarge

(Supply: Creator)

DocuSign’s valuation

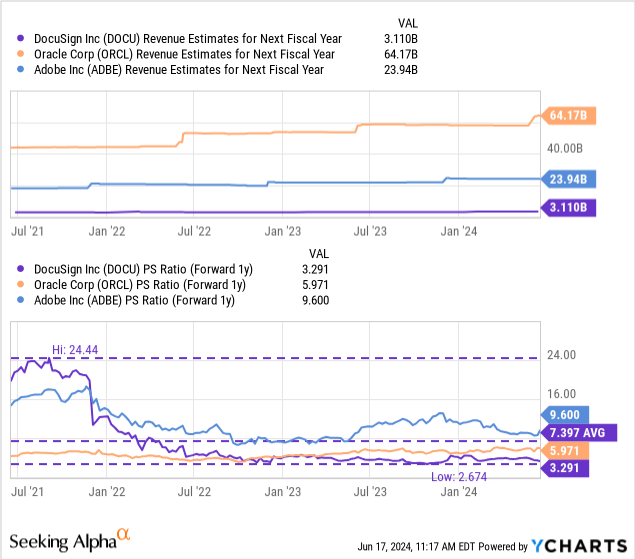

DocuSign’s shares are valued at a P/S ratio of three.3X, which is considerably under the corporate’s long run price-to-revenue valuation common of seven.4X. Shares have been valued extremely prior to now, particularly through the pandemic, however with slowing top-line development, traders have additionally reevaluated DocuSign’s valuation issue. Different software program corporations with comparable software program provides, like Adobe (ADBE) and Oracle (ORCL) have a lot greater valuation ratios, however these corporations have longer working histories, are additionally worthwhile on a web revenue foundation and are rising sooner.

Adobe is anticipated to develop its high line 13% in FY 2025 in comparison with 11% for Oracle and 6% for DocuSign. I consider shares of DocuSign might commerce on the business common P/S ratio of 6.3X in the long run, however solely underneath the situation that the corporate improves its retention fee and advances its product supply to such an extent that the corporate advantages from stronger income development. If DocuSign traded on the business P/S ratio of 6.3X, shares might have a good worth of as much as $95.

Dangers with DocuSign

There are two main dangers that I see with DocuSign. The primary pertains to its slowing top-line development fee and the second associated to the corporate’s greenback web retention dangers, which signifies the potential for destructive income development. If clients proceed to sluggish their spending on the DocuSign platform, there’s a actual likelihood that the corporate’s top-line development will fall into the low-single digits within the close to future. Provided that DocuSign managed to reverse its dollar-based web retention pattern in a sustainable method (a minimum of three consecutive quarters of retention development with a fee above 100%), then a ranking improve could also be justified, in my view.

Last ideas

DocuSign continues to see slowing income development which is, partly, associated to weakening buyer monetization for the software program firm, as proven by a greenback web retention fee of 99%. DocuSign, nonetheless, is sort of worthwhile on a free money stream foundation and delivered strong FCF margins within the final quarter. To a sure extent, DocuSign’s excessive FCF margins offset weak spot in buyer monetization, in my view, and due to this fact the agency’s draw back potential might also be restricted. I might solely comply with a ranking improve to purchase if DocuSign had been to make enhancements when it comes to buyer monetization and its greenback web retention fee. If it achieves that, I consider shares might revalue greater comparatively shortly. So long as that does not occur, nonetheless, I’ll affirm my maintain ranking for DocuSign’s shares.